While Easter usually brings a sense of renewal, the crypto markets are telling a very different story. Trading activity has plummeted across both centralized and decentralized exchanges, sinking to levels not seen in half a year. So, what’s really going on — and should investors be concerned?

Crypto Trading Volumes Are in Free Fall

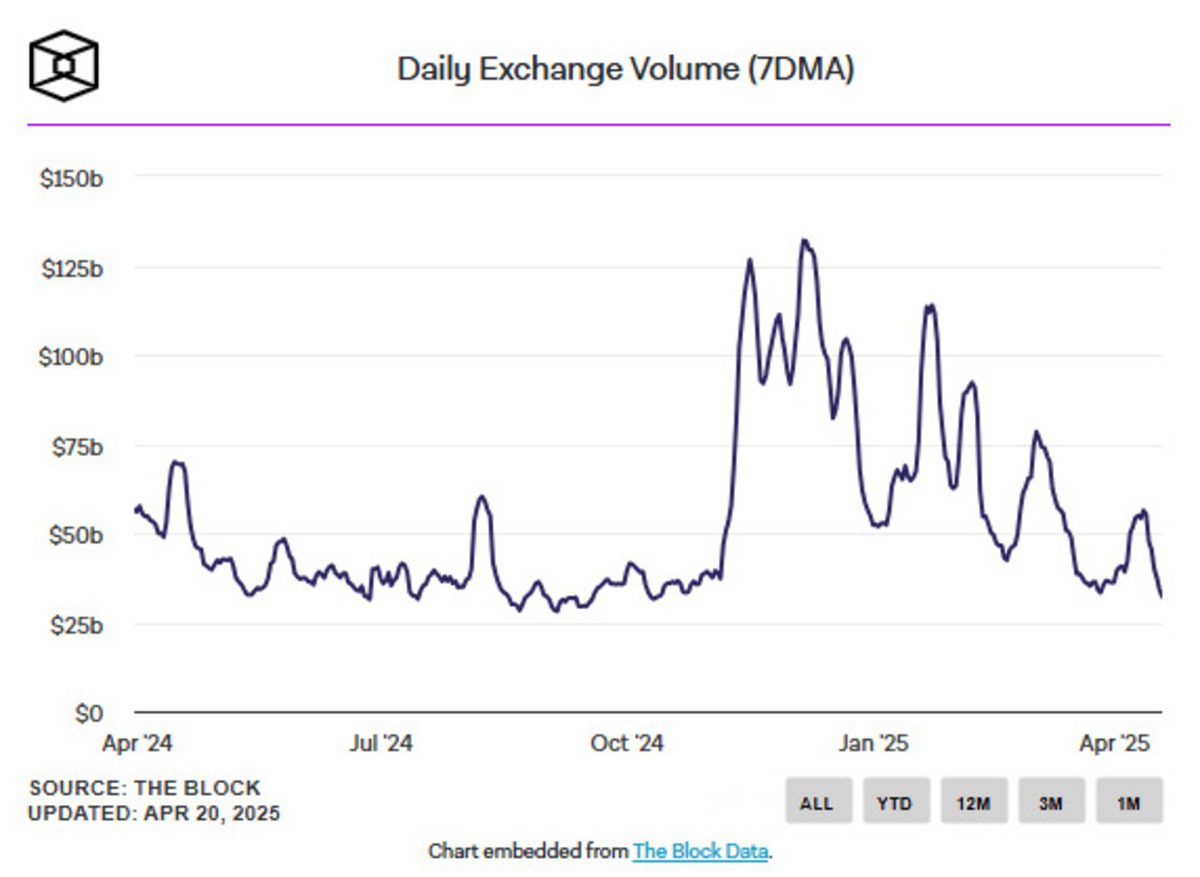

According to data from The Block, the 7-day moving average of trading volume on major platforms like Binance, Coinbase, and Bitfinex recently slid to just over $32 billion. That’s the lowest figure recorded since mid-October 2024, representing a stunning 75% decline from the peak of $132 billion seen back in early December.

Even crypto ETFs aren’t immune. Spot Bitcoin ETFs posted just $1.55 billion in traded volume last Thursday, marking their weakest day since March 25. Ethereum spot ETFs followed a similar trend, with trading volumes dropping to $178.76 million — their lowest point since late March.

The drop isn’t limited to total volume either. The spot-to-futures trading ratio for Bitcoin has sunk to 0.19, its lowest since August 2024. For Ethereum, the ratio stands at 0.20, the weakest reading since December 2023.

Daily trading volumes on major crypto platforms in billions of dollars

Traders Pivot Toward Futures

The numbers paint a clear picture: traders are increasingly favoring futures markets over spot trading. Why? Futures offer higher leverage and more speculative opportunities, particularly appealing when price action slows. Meanwhile, spot trading — typically a sign of organic, long-term investment demand — is clearly suffering.

One surprising exception? Solana. Unlike most of the market, Solana actually saw a slight increase in weekly spot trading volume compared to Ethereum. According to The Block, Solana reversed a months-long decline and even captured 70% of crypto app revenues on April 20, offering a rare bright spot amid the general gloom.

What’s Next for the Crypto Market?

The big question is how long this period of market apathy will last. Analysts at Goldman Sachs suggest that the ongoing decline of the U.S. dollar could eventually reignite interest in Bitcoin and the broader crypto sector. However, political uncertainty — particularly with volatile moves from the new administration in Washington — could easily derail any potential recovery.

For now, investors would be wise to watch both macroeconomic trends and on-chain activity carefully. Low volumes often precede periods of heightened volatility — and in crypto, the calm rarely lasts long.