As we look ahead to 2025, the tech sector continues to provide both challenges and opportunities. With the market showing signs of volatility, many investors are looking for stocks that can weather the storm and continue to deliver growth. Two companies that stand out in the current landscape are Spotify and Meta Platforms. While some tech stocks are struggling, these two have demonstrated remarkable resilience and growth potential, making them excellent choices for investors looking to position themselves for success in the coming year.

Spotify: A Strong Contender for 2025

Despite a challenging year for the tech sector, Spotify Technology has managed to stand out as a top performer in the market. The streaming giant has seen an impressive 28% increase in stock value so far in 2025, a remarkable achievement in the face of overall market volatility. This surge highlights what’s known as relative strength—meaning Spotify is outperforming its peers, even when the broader market is under pressure.

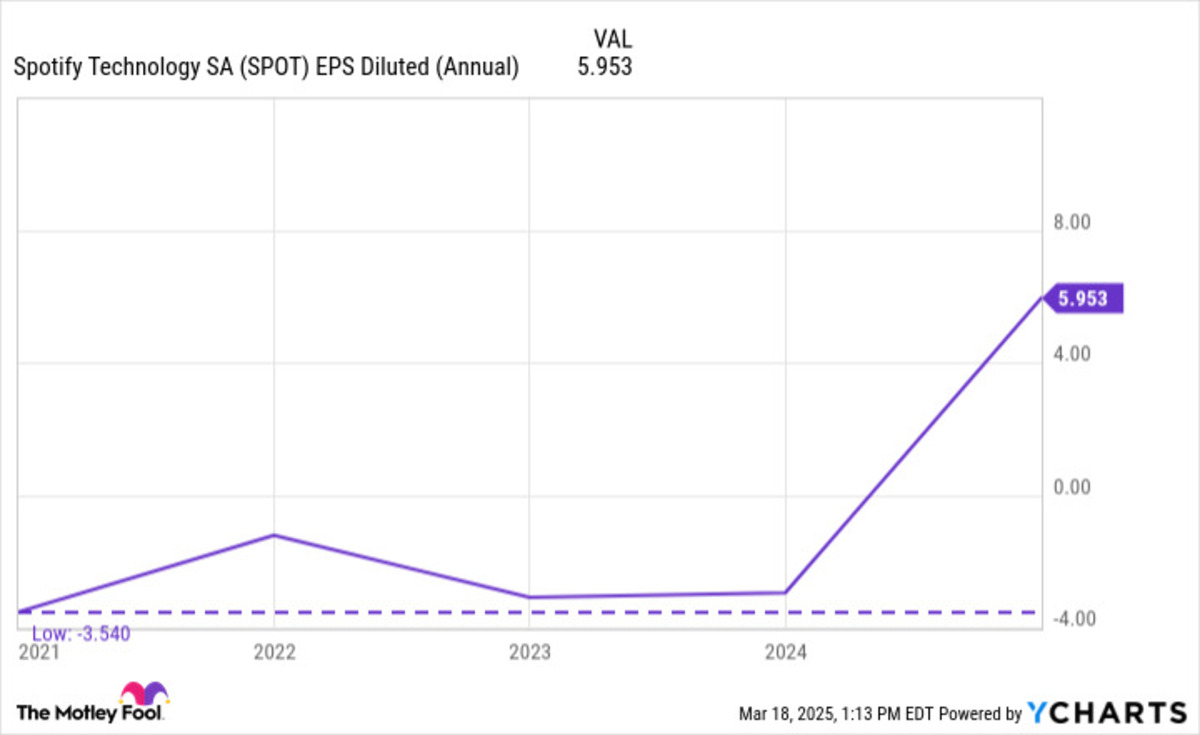

But why has Spotify gained such favor with investors? At its core, investors are drawn to Spotify’s impressive growth and newly restored profitability. Over the last five years, the company has demonstrated an average quarterly revenue growth of nearly 18%. But what truly excites investors now is the company’s ability to turn recent losses into gains, a transformation achieved through price increases and cost-cutting measures. In 2021, Spotify reported a net loss of $3.54 per share. Fast forward to 2024, and that loss has flipped into a positive $5.95 per share—a remarkable turnaround that has reinvigorated investor confidence.

Spotify’s long-term growth potential and ability to generate profits in 2024 make it a solid pick for investors looking for growth stocks in 2025. With its strong market position and commitment to profitability, Spotify is a company to watch closely.

Meta Platforms: A Powerhouse for the Future

Another tech stock that deserves attention as we move into 2025 is Meta Platforms. While its stock price has remained relatively flat this year, Meta continues to show resilience, especially compared to major market indices. For a company that has previously delivered over 100% returns in recent years, this stability is a good sign for its future performance.

What makes Meta such a strong pick? The company boasts an impressive user base, with more than 3.3 billion daily active users across its platforms like Facebook and Instagram. With billions of users interacting with its social media platforms every day, Meta’s advertising model essentially runs on autopilot, bringing in over $500 million per day from advertisers. This consistent revenue stream gives Meta the stability it needs to reinvest in growth opportunities and maximize returns for its shareholders.

In addition to its strong revenue growth, Meta’s financial performance continues to impress. In its most recent quarter, the company generated:

- $48 billion in revenue

- $21 billion in net income

- $13 billion in free cash flow

This level of cash flow gives Meta the flexibility to reinvest in its business through share buybacks, debt reduction, or dividends for shareholders. It’s no wonder that many investors view Meta as a top-tier tech stock moving into 2025.

Why Invest in These Stocks Now?

As we approach 2025, the tech sector presents a mixed landscape, but Spotify and Meta are among the stocks poised for success. Spotify’s resurgence in profitability and Meta’s impressive financial strength make them standout picks for investors looking to diversify their portfolios with solid tech options.

While investing in stocks always carries risk, these two companies have demonstrated resilience in turbulent markets, and their long-term growth potential positions them well for the future. Whether you’re an experienced investor or just getting started, keeping an eye on these stocks could pay off as we head into the next chapter of the tech boom.

So, before 2025 really takes off, consider adding Spotify and Meta to your watchlist. With their strong fundamentals and growth outlook, these stocks are ready to take on the future—are you ready to join them?